It is efficacious for assessing overall liquidity and analyzing businesses with significant inventory holdings. In distinction, the fast ratio focuses on probably the most liquid assets, excluding inventory, offering insight into quick liquidity needs. The fast ratio, also called the acid-test ratio, measures a company’s capacity to pay off short-term liabilities utilizing solely its most liquid property (like money and receivables).

This would be value extra investigation because it’s likely that the accounts payable should be paid earlier than the entire balance of the notes-payable account. Firm A also has fewer wages payable, which is the legal responsibility most probably to be paid in the quick time period. Businesses differ considerably among industries; evaluating the current ratios of firms throughout completely different industries could not lead to productive perception. This could point out that the company has higher collections, sooner stock turnover, or just a greater capacity to pay down its debt. The current ratio is often a useful measure of a company’s short-term solvency when it is positioned within the context of what has been historically regular for the company and its peer group.

- It is a short-term monetary obligation that a company expects to pay inside one yr or accounting interval.

- You can shortly get a snapshot of the company’s capacity to pay its short-term debts by utilizing the present ratio equation.

- Subsequently, even though its ratio is 1.45x, strictly from the short-term debt repayment perspective, it’s best positioned as it could possibly instantly repay its short-term debt.

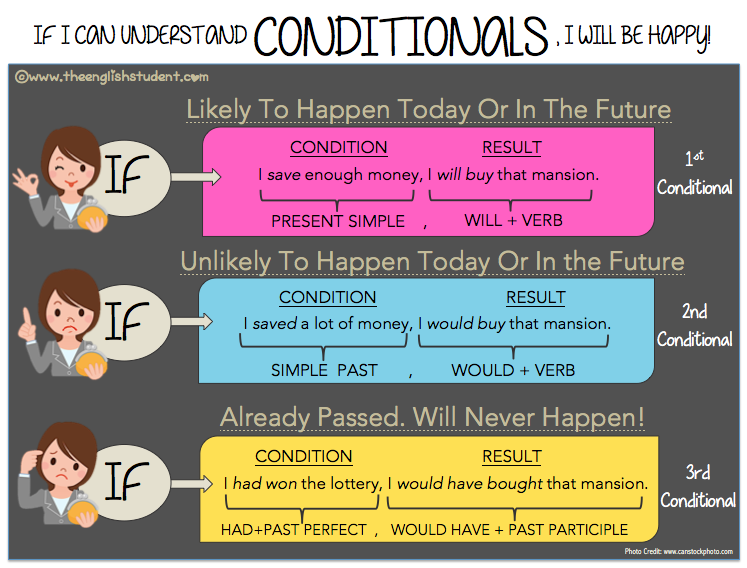

- The key difference between the fast ratio and the present ratio is that the quick ratio excludes inventory and prepaid bills.

- If an organization has a very excessive present ratio compared with its peer group, it signifies that administration may not be utilizing its property effectively.

Quick Ratio Method And Calculation

It additionally appears at how a company can maximize the liquidity of its present assets to settle its liabilities and debt obligations. The present ratio is a liquidity ratio that measures a company’s capability to pay off its short-term liabilities with its short-term assets. It is calculated using the present ratio formula, current belongings divided by complete current liabilities. The difference between the present ratio and the fast ratio is essential for financial evaluation.

To offer you an idea of sector ratios, we have picked up the US automobile sector. For example, in a single trade, it may be more typical to increase credit score to shoppers for 90 days or longer, while in another trade, short-term collections are more crucial.

Inventory inflates the present ratio since it’s included within the calculation of current property. However, the quick ratio excludes stock, making it a extra conservative indicator of liquidity. The quick ratio is extra conservative as a outcome of it excludes stock, which is in all probability not easily liquidated in the short term. This gives a more accurate image of a company’s capability to meet short-term obligations without counting on inventory sales.

For occasion, imagine Company XYZ, which has a big receivable that is unlikely to be collected or extra inventory which may be obsolete. Each circumstances may scale back the present ratio at least briefly. Here, the Current Ratio and Fast Ratio bob along, ready to inform their liquidity tales. Pace up money conversion with tighter invoicing and collection, scale back excess inventory by way of just-in-time buys, and negotiate longer payables. Use short-term financing strategically to smooth cash circulate throughout spikes.

What Are The Key Differences Of Present Vs Quick Ratio?

Since the present ratio formula is quite helpful to research a business’s monetary health, it also has some type of downside. This time period refers to business assets which are simply convertible into cash, sellable, or usable inside one year or the accounting period. It is important to grasp short-term liquidity, which enables the meeting of instant obligations. Here are two liquidity ratios which would possibly be useful alongside the current ratio. You’ll discover your current belongings and current liabilities on your balance sheet.

Look At whether or not belongings are truly liquid and if liabilities bunch in particular months. Not each excessive number alerts power; context reveals whether or not surplus funds serve growth or sit idle. Readings beneath 1 recommend extra short-term liabilities than belongings and raise immediate pink flags for pay short-term needs. When money needs are tight, comparing two short-term metrics reveals how a lot liquidity actually lies within attain. You should consult your individual skilled advisors for advice instantly relating to your business or before taking motion in relation to any of the content supplied. Xero takes care of the complex calculations for you, so you might have a clear view of the cash obtainable in your business.

This means, you’ll be able to easily evaluate your company’s capacity to pay debts or short-term obligations. The greatest part of using the current ratio formulation is to monitor your business’s monetary parameters. It assists you in making knowledgeable decisions and managing working capital efficiently. Besides this, it helps in working inventory, accounts receivable, accounts payable, and different business operations. With both values in hand, one can proceed to calculate the current ratio by dividing the entire present property by the entire current liabilities. The present ratio is an important metric for evaluating a company’s financial health.

Company B has additional cash, which is essentially the most liquid asset, and more accounts receivable, which might be collected more quickly than liquidating inventory. Although the total worth of current assets matches, Firm B is in a extra liquid, solvent position. Comparing an organization’s ratios to its historic trends usually provides extra useful insights than evaluating them to industry averages. A declining trend in either ratio may sign deteriorating financial well being, even when absolutely the numbers remain above traditional benchmarks. Conversely, consistently low ratios would possibly indicate efficient working capital management rather than financial distress.

Current Ratio = Current Property ÷ Present Liabilities

A liquidity ratio is a monetary metric that determines a debtor’s (usually a company’s) ability to repay its debt without https://www.simple-accounting.org/ exterior sources of funds. To summarize, Liquids, Inc. has a cushty liquidity place, but it has a dangerously high diploma of leverage. While profitability ratios focus on producing returns and maximizing income, liquidity ratios prioritize sustaining enough cash to cowl short-term obligations. Liquidity ratios additionally facilitate comparison across companies and industries.